Bankruptcy law is a legal framework designed to address situations in which individuals or organizations are unable to repay outstanding debts. It regulates the processes by which assets may be assessed, distributed, or restructured among creditors through formal legal procedures. Bankruptcy law aims to balance the rights and interests of the debtor and the creditors, providing an orderly way to resolve insolvency while maintaining legal standards and protections.

This area of law encompasses various types, each offering different approaches to debt relief and asset distribution. The processes may involve liquidation, the creation of repayment plans, or organizational restructuring. Bankruptcy law typically establishes statutory protections for debtors, while also outlining rules that creditors must follow. The legal proceedings can be initiated voluntarily by debtors or involuntarily by creditors under certain circumstances.

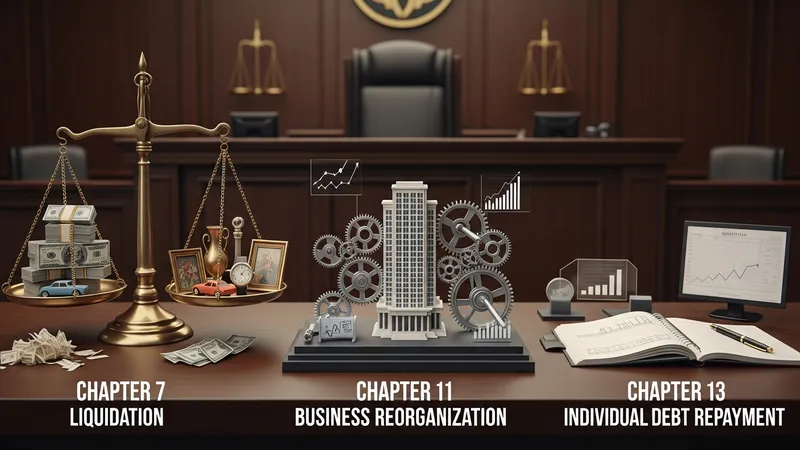

The classification of bankruptcy types is based on eligibility, purpose, and procedures. Liquidation typically applies to individuals with limited assets, whereas reorganization is more suited to entities requiring continued operation under revised obligations. Court supervision helps ensure fair application of rules and protection for both debtors and creditors throughout the process.

Bankruptcy processes usually start with the filing of a petition, either by debtors seeking relief or by creditors wishing to resolve outstanding accounts. The court then oversees documentation, notification, and distribution steps according to established guidelines. This structure allows for transparent evaluation of assets, claims, and eventual outcomes, which could include discharge of certain debts or court-supervised repayment plans.

Legal rights under bankruptcy law are outlined by statutes that typically address the automatic stay (halting collection actions during proceedings), exemptions for certain personal assets, and the pathway to debt discharge. Creditors also receive protections and orderly access to any distributable assets, following judicial oversight and prioritization rules. The balance between debtor relief and creditor fairness is central to the ongoing effectiveness of bankruptcy laws.

Bankruptcy law continues to be shaped by legislative changes and judicial interpretations. While the main objectives remain consistent—ensuring fair outcomes for both parties—changes in economic conditions or legal precedent may influence available options, eligibility, and specific rights over time. Those considering or encountering bankruptcy should be aware of these dynamic components and the administrative safeguards built into the process.

In summary, bankruptcy law covers various types, processes, and legal rights, each with its defined scope and eligibility. Understanding these facets is fundamental to navigating insolvency concerns in a law-abiding and structured manner. The next sections examine practical components and considerations in more detail.

Bankruptcy laws generally categorize filings by the nature and context of the debtor’s financial difficulties. Chapter 7, Chapter 11, and Chapter 13 are commonly referenced forms, each designed for distinct circumstances. Chapter 7 focuses on liquidation, requiring non-exempt assets to be sold with proceeds distributed among creditors. Chapter 11 permits reorganization for businesses seeking to continue operations and negotiate new terms with lenders. Chapter 13, meanwhile, enables individuals with steady income to repay debts under court supervision, often over a specified period. These structures illustrate the different approaches legal systems take in managing insolvency cases.

Eligibility for each bankruptcy type typically depends on various legal and financial criteria. For instance, Chapter 7 may require the debtor to pass a means test, evaluating income relative to living costs and existing debt. Chapter 11 is generally employed by corporations, partnerships, or individuals with significant, complex debts. Chapter 13 sets requirements regarding debt limits and proof of reliable income. By setting these parameters, the law aims to guide filers toward the most appropriate pathway and to ensure that the relief provided matches both the debtor's and creditors' interests.

The procedural differences between bankruptcy types also influence outcomes and obligations. While Chapter 7 can often result in the expedient discharge of qualifying debts following asset liquidation, Chapter 11 and 13 cases may be more prolonged due to negotiation and restructuring phases. These distinctions affect the scope of debtor protections, creditor returns, and the timeline for legal resolution. Understanding the implications and requirements of each type is foundational when navigating bankruptcy law’s application in practice.

Choosing between bankruptcy types is impacted by the nature of debts involved, the structure of income and assets, and the long-term objectives of the parties. For instance, businesses aiming to preserve functions and relationships typically consider Chapter 11, while individual debtors with substantial secured debts may contemplate Chapter 13. Legal counsel and court oversight ensure that the chosen route complies with legislation and maintains equilibrium between the rights of all involved. The next section explores the main procedures within bankruptcy law.

Bankruptcy proceedings start when a petition is filed in the appropriate court. This petition can be voluntary—initiated by a debtor seeking relief—or involuntary—often started by creditors meeting specific legal prerequisites. The filing process includes disclosing financial details, which are subject to verification and review. The court appoints a trustee in certain cases, especially under Chapter 7, to administer and oversee the orderly liquidation or management of assets. Information accuracy is critical, as any errors can influence the outcome or prolong the process.

The automatic stay is a notable legal mechanism triggered by the bankruptcy filing. This provision halts most collection actions against the debtor, including lawsuits, wage garnishments, and communications from creditors. The stay remains effective during the period of legal proceedings, providing debtors with a temporary reprieve and an opportunity to organize their financial matters. There are exceptions and limitations to this protection, often based on the specifics of the case or applicable law.

In liquidation cases, the trustee gathers and evaluates the debtor’s non-exempt assets. These may be sold, with proceeds distributed to creditors according to statutory priorities. In contrast, reorganization or repayment plan cases require the submission and approval of detailed proposals, outlining how debts will be addressed moving forward. The court, alongside stakeholder input, evaluates the feasibility and fairness of these plans before implementation. Compliance with court mandates throughout the process is essential for all parties.

Discharge of debt or structured repayment marks the conclusion of bankruptcy cases. Once the court validates compliance and fulfillment of obligations, remaining qualifying debts may be wiped out or considered satisfied under the terms of the repayment plan. The outcome, timing, and scope of relief may depend on adherence to all procedural requirements and the particular chapter under which the case was filed. The next page will examine the rights and protections structured into bankruptcy law for debtors and creditors.

Central to bankruptcy law are carefully defined legal protections for debtors. The automatic stay, for example, prevents most collection activities during the bankruptcy case, allowing debtors crucial time to assess their financial options without external pressure. Statutory exemptions further safeguard certain assets, such as basic household goods or personal items, from liquidation. These protections are designed to support a fair process and provide a foundation for potential financial recovery where appropriate.

Creditors’ rights are also embedded in bankruptcy statutes. They possess the ability to file claims, attend hearings, and, in some cases, object to debtor proposals or asset exemptions. The law establishes a clear order of priority in repayment based on debt category—secured, unsecured, and administrative—ensuring transparency and predictability. This framework allows creditors to participate actively in proceedings while upholding rules set by legislative bodies and courts.

Bankruptcy law further incorporates provisions for dischargeable and non-dischargeable debts. Certain obligations, such as some taxes, student loans, or domestic support, may not be eliminated through bankruptcy, depending on jurisdiction. Debtors are required to complete mandated financial education courses as part of the process in many regions. These measures support a more informed approach to post-bankruptcy financial management and aim to reduce recidivism in filings.

The combination of debtor relief, creditor rights, and judicial oversight helps maintain balance and public confidence in the bankruptcy system. Legal statutes are structured to ensure that protections are neither overly lenient nor unduly restrictive, reflecting broader policy objectives. The concluding section discusses the continuing developments and considerations in bankruptcy law.

Bankruptcy law continues to evolve in response to changes in economic conditions, debtor profiles, and policy objectives. Legislative amendments may adjust eligibility thresholds, procedural requirements, or the scope of exemptions to address emerging needs. For example, periods of widespread economic downturn often prompt temporary provisions or reforms aimed at managing increased filings. These changes typically undergo extensive analysis and are designed to preserve the fundamental balance between creditor and debtor interests.

Judicial interpretation also plays a significant role in shaping bankruptcy outcomes. Courts may issue rulings that clarify definitions, interpret statutory ambiguities, or resolve procedural disputes. Over time, these decisions contribute to a body of case law that informs the expectations and strategies of all participants. Legal professionals often study relevant rulings and statutory changes to navigate cases efficiently and meet required standards.

Practical considerations, such as the administrative capacity of bankruptcy courts and the availability of trustee or counseling resources, may affect the experience of filers and creditors. The efficiency of case management, the speed of asset distribution, and the clarity of procedural guidance can all impact perceptions of fairness and accessibility. Ongoing assessment of these factors is vital for refining the system and addressing any consensus concerns.

As bankruptcy law addresses both individual and organizational insolvency, its application reflects a wide array of financial realities. Continued attention from lawmakers, judges, and practitioners helps ensure that bankruptcy remains a viable legal remedy, capable of adapting to new challenges while upholding the rights and responsibilities of all parties involved.